Eliminate your exposed liabilities, so you can focuson what’s important

HD™ 2.0 | CMS® (Compliance Management System) is a one of a kind compliance management solution for collection agencies and financial service providers that ensures all policies and procedures set out by the CFPB are followed without any effort the the part of your users.

Each module and application within the compliance management system is fully comprehensive to ensure all facets of compliance set out by the CFPB are covered, while remaining simple in appearance and use to promote efficiency and user-friendliness.

What our clients are saying...

“Frankly, I’m blown away/impressed by what you’re able to accomplish and the expertise you bring to the table. Your innovation is unmatched, that’s why I bought into your

technology.”

Issa K. Moe General Counsel and Chief Compliance Officer

First National Collection Bureau, Inc.

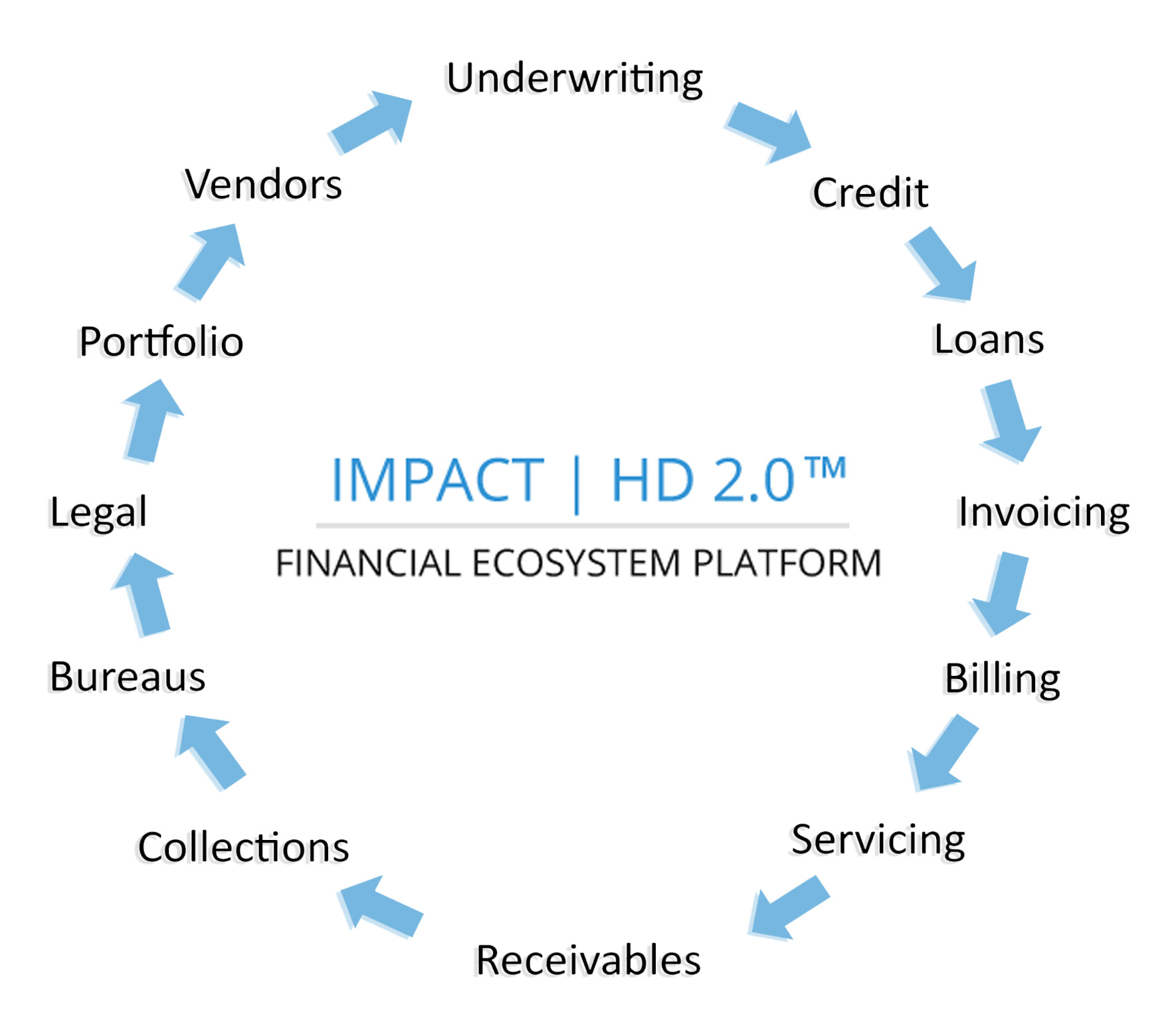

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the technical mismanagement of financial transactions where aging receivables quickly turn into bad debt & ultimately to a loss. A “Financial Ecosystem” resolves this problem, as it is a battery of proprietary fintech systems & solutions that consolidate into a single Financial Platform across your enterprise.

Easy Policy Configuration

HD™ 2.0 | CMS® allows collection agencies and financial service providers to quickly and effortlessly implement new policies throughout your enterprise by dynamically leading the configuration process through each phase of CFPB compliance.

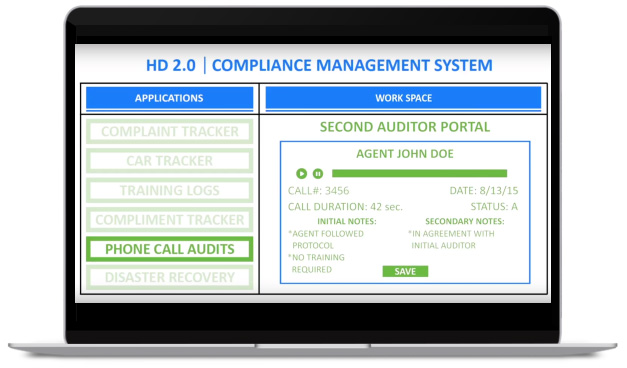

Dual Phone Call Auditing

HD™ 2.0 | CMS® compliance management solution for collection agencies and financial service providers provides a streamlined dual phone call auditing process. This comprehensive auditing procedure ensures that each phone call is in compliance or is adequately corrected if it is not.

Dynamic Complaint Tracking

HD™ 2.0 | CMS® dynamically logs all pertinent compliant information and systematically links it to the corresponding agent profile, ensuring each complaint is dynamically tracked.

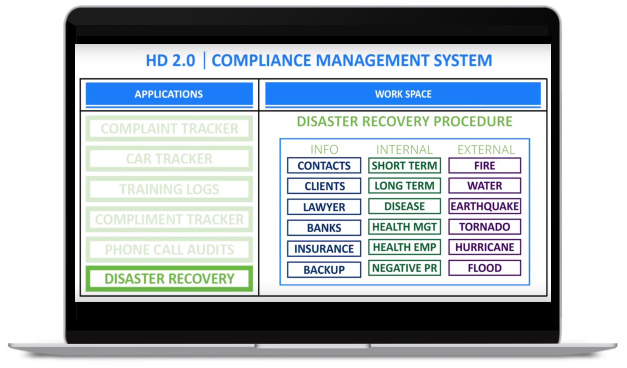

Disaster Recovery

HD™ 2.0 | CMS® equips your organization with a fully customized contingency disaster recovery security plan that stores all vital company information, provides a plan of action in the event of a disaster, and does not expose sensitive consumer data.

HD™ 2.0 | CMS® Compliance Management System functionality

The HD™ 2.0 | CMS® provides efficiencies and optimization for compliance assurance operations, such as:

- Policy creation

- Disaster Recovery

- Dual Phone Call Auditing

- Complaint Tracker

- Compliment Tracker

- Corrective Action Report Tracker

- Training logs

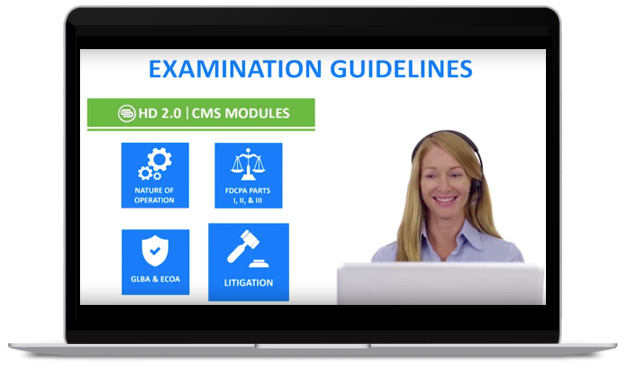

- CFPB Examination Guideline Modules

- Nature of Operation Compliance

- FDCPA I, II, & III Compliance

- GLBA & ECOA Compliance

- Litigation compliance

Protect your company with these compliance solutions

Modules

HD™ 2.0 | CMS® solution for collection agencies and financial service providers not only simplifies the creation and implementation of new policies, but the system’s modules mirror the CFPB examination guidelines in sequence and in content to ensure each of your policies are created and executed within all set-forth compliance guidelines.

Benefits:

- Each policy contains indicators to ensure policies are in place, are properly documented, staff is trained, there is evidence of policy implementation, steps for corrective action are in place, and that the policy has been audited.

- Nature of Operation Compliance Module

- FDCPA Parts I, II & III Compliance Module

- GLBA & ECOA Compliance Module

- Litigation Compliance Module

Applications

HD™ 2.0 | CMS® equips your organization with several compliance assurance applications that are vital to ensuring compliance.

Benefits:

- Complaint Tracker

- Compliment Tracker

- Corrective Action Report Tracker

- Dual Phone Call Audit

- Training Log

- Disaster Recovery

The HD™ 2.0 | CMS® solution helps entities of all types effortlessly operate and grow without breaching compliance

No matter what type of business or what role you work, HD™ 2.0 | CMS® helps you work more efficiently.

Business Types

Business Types

Banks

HD™ 2.0 | CMS® provides a set of tools designed to protect banking institutions from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Dynamic complaint linking

- Compliment tracker links compliments to accounts to offset complaints

- Corrective Action Report tracker ensures complaints are addressed and corrected with the appropriate course of action

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

Collection Agencies

HD™ 2.0 | CMS® provides a set of tools designed to protect collection agencies from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- Dual Phone Call audit feature allows two separate individuals to independently audit phone call recordings while following along with a checklist of each of the 29 FCDPA rules in order to adequately assess if each rule was sufficiently followed.

- If any rules are found to be broken, the call is sent to the corrective action report tracker to address the non-compliance and provide correction.

- The corrective action report becomes a part of the account record, so if the CFPB finds this instance of non-compliance, correction has already preemptively occurred, demonstrating company responsibility and dedication to compliance and customer care.

Credit Card

HD™ 2.0 | CMS® provides a specialized set of tools designed to protect credit card institutions from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Security data encryption to close compliance gaps to prevent identity theft/fraud/embezzlement exposure

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

Credit Reporting

HD™ 2.0 | CMS® provides a set of tools designed to protect credit reporting institutions from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Dynamic complaint linking

- Compliment tracker links compliments to accounts to offset complaints

- Corrective Action Report tracker ensures complaints are addressed and corrected with the appropriate course of action

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

Loan Agencies

HD™ 2.0 | CMS® provides a set of tools designed to protect loan agencies from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Dynamic complaint linking

- Compliment tracker links compliments to accounts to offset complaints

- Corrective Action Report tracker ensures complaints are addressed and corrected with the appropriate course of action

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

Money Transfer

HD™ 2.0 | CMS® provides a set of tools designed to protect money transfer institutions from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Dynamic complaint linking

- Compliment tracker links compliments to accounts to offset complaints

- Corrective Action Report tracker ensures complaints are addressed and corrected with the appropriate course of action

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

Other Financial Service Providers

HD™ 2.0 | CMS® provides a set of tools designed to protect financial service institutions from breaking CFPB compliance regulations and drastically reduce complaints, while also providing corrective action procedures if compliance is broken or a complaint is received.

Benefits:

- CFPB Policy Compliance assurance

- Comprehensive time-stamped audit trail demonstrating policy configuration, implementation, and execution on accounts

- Dynamic complaint linking

- Compliment tracker links compliments to accounts to offset complaints

- Corrective Action Report tracker ensures complaints are addressed and corrected with the appropriate course of action

- Documentation of company accountability, responsibility, and dedication to remaining compliant and maintaining a positive reputation

User Types

User Types

Agents

Agents

HD™ 2.0 | CMS® helps agents and administrators at all levels effectively and efficiently remain compliant when handling customers and account information through all phases of business process regardless.

Technology Staff

Technology Staff

Whether you’re the organization's Chief Information Officer, IT Director, or IT Manager, supporting a system that is manageable, adaptable, and secure is your number one priority. HD™ 2.0 | CMS® offers key technology features to assist such as:

- Open Web Services Library – Allows IT staff to compress implementation time and support current and new third-party partners without relying on the vendor.

- Ad Hoc Reporting Toolkit – Allows tax staff to independently construct new custom reports on demand without relying on the vendor.

- Visual Rules Engine Workflow Manager – Automates the execution of systematic actions based on bureau and consumer provided data enabling non-technical finance and IT staff to manage business rules and data values.

- Configuration Manager – Allows non-technical firm and IT staff to tailor code their own windows, workflows, reports, dashboards, and values as well as data lookup tables such as accounts, consumers, events, tasks, calendars, and data grids in a simple user-friendly and dynamic environment.

HD™ 2.0 | CMS® Support

Our customer service team has extensive experience in compliance technology, project management, user training, and software development. They understand the key issues, challenges, and can help save you time and increase efficiencies with support at implementation and beyond.

Dedicated project manager

As a HD™ 2.0 | CMS® customer, you’ll have a CSS consultant as your single point of contact – committed to helping your organization get the most out of your compliance management system.

Automatic system upgrades and maintenance

Our engineers and analysts continually build and improve on an already superior product – with upgrades and maintenance automatically applied for hassle-free operation.

Experienced, knowledgeable support staff

Our experienced customer support team understands the complexities of compliance management and assurance, so they make sure everything – from implementation to training – goes smoothly with minimal disruption.

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the inadequate adoption of fintech technology for financial transactions management whereby mismanaged, aging receivables quickly turn revenues into bad debt and ultimately into losses. The primary reason for this outcome is the lack of a single enterprise solution that can manage every aspect of the revenue management life cycle process across all business units in unison.

Traditional platforms are stand-alone, independent systems that don't share common technology & can’t communicate dynamically with one another, leaving business units separated. This leaves entities with old, stale financial data, making it impossible to both manage aging receivables & avoid uncollectable debt. A Financial Ecosystem resolves this problem. A Financial Ecosystem is a battery of highly sophisticated proprietary fintech systems & solutions that consolidate into one single Financial Platform across your enterprise. HD™ 2.0 | Enterprise Financial Ecosystem® is that end-to-end financial platform that manages your revenues and receivables, while safeguarding bad debt exposure.

Parts of a Financial Ecosystem

HD™ 2.0 | LMS® Loan Management System (LMS) enables credit grantors & servicers to create business rules for underwriting decisioning workflows simply & visually without the need of complicated coding. LMS can systematically control financial screen navigation, input/output, verbose messaging and database interactions from any internal or external system or framework.

Now, when new applications for underwriting are introduced, they are first “interrogated” by the LMS business rules engine, which then gives a “thumbs up, thumbs down” decision.

This approach enables organizations to evaluate the application against multiple internal or external data sources and predict which applications should be manually reviewed, versus those that are most expected to contain appropriate information for automatic underwriting.

HD™ 2.0 | LMS® offers:

- Automation of manual procedures and calculations: By utilizing an automated analytic-based underwriting system, the consistency, quality and capacity of underwriting could be dramatically improved, allowing underwriters to focus on the exceptions.

- Control by business users: Rules are designed in an easy-to-understand visual Visio-like workflow designer, enabling the business experts— rather than technical staff—to control and automate procedures and policies.

- Faster response to change: Time-to-market for business logic changes are reduced from weeks and months to days or hours. Systems can be updated while in production with no down time and no need for IT resources.

- Increased reliability and auditability: A centralized workflow decisioning rules repository provides consistent execution of business policies that are easy to manage and visually easy to audit.

HD™ 2.0 | LMS® business rules engine allows for the development and rapid deployment of complex credit granting business rules, so your organization can make better decisions across the Revenue Life Cycle. Automate and optimize numerous types of business decisions, including credit approve/decline, instant prescreen offers, and collection decisions.

With HD™ 2.0 | LMS® you can also systematically analyze scoring, business rules and decision strategies from external data systems. This enables continuous testing and fine tuning of your business rules, so you can optimize decision strategies to drive higher profits.

- Pull data from multiple sources — both internal and external — into your decisioning engine dynamically.

- Process a high volume of transactions, with support and availability 24 hours a day

- Gain the ability to calculate numerous predictive attributes with self-designed scoring models

- Test new strategies against your current decision models and perform what-if simulations on historical data

- Improve business process efficiencies with continuous-loop deployment of enhanced and optimized decision strategies

- Deploy new decisioning strategies dynamically, to respond to market changes rapidly

- Deliver dynamic real-time, instant decisions while customers are at the point of sale

- Seamlessly integrate LMS's workflow decisioning engine into your existing systems with minimal IT costs

HD™ 2.0 | LMS® is specially designed to simplify and automate all loan processes from start to finish. This intelligent solution shepherds the user through each phase of the loan servicing process, presents the freshest data in real-time, and intuitively computes all calculations providing the easiest user-experience available anywhere.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver a salient automated enterprise invoicing solution. Generate business rules-driven invoicing with a built-in document management system. Offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

Give your customers what they want with customer-centric invoicing and payment options. Shorten your revenue cycle with a multitude of automated payment and invoicing technology solutions and easily track partial payments and past due invoices.

HD™ 2.0 | PRISM® Loan Invoicing & Billing (LIBS) enables organizations and third-party administrators to deliver an automated rules driven receivables management process across the enterprise. Seamlessly retrieve documents, contracts or any other information from the ecosystem, generate and disseminate accurate billing within our integrated financial ecosystem technology platform. Offering online access for consumers and third-party administrators reduces dependence on in-house customer service personnel and improves client satisfaction.

With over 300+ modules dedicated to billing in real-time, HD™ 2.0 | PRISM® (LIBS) provides the most comprehensive, state of the art tools to meet all your billing needs. With unparalleled automation, HD™ 2.0 | LIBS® minimizes training while maximizing production.

HD™ 2.0 Enterprise Financial Ecosystem presents the most sophisticated tool set available for account receivables management. Adaptable for any business or organization type, HD™ 2.0 Enterprise Financial Ecosystem allows your entity to confidently expand across multiple verticals for geometric growth.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver an automated rules-driven billing solution across the enterprise. Seamlessly retrieve documents, contracts, and offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

With over 300+ modules dedicated to billing in real-time, HD™ 2.0 | RMS® provides the most comprehensive, state of the art tools to meet all your billing needs. With unparalleled automation, RMS minimizes training while maximizing production.

HD™ 2.0 | RMS® Receivables Management System (RMS) presents the most sophisticated tool set available for account receivables management, adaptable for any business or organization type. With capabilities to tie into the HD™ 2.0 Enterprise Financial Ecosystem, you can confidently expand your offerings across multiple industries and verticals for geometric growth.

HD™ 2.0 | RCM® is a healthcare Revenue Cycle Management (RCM) system designed to manage claim submissions, self-pay & insurer billing & recoveries.

HD™ 2.0 | TAX® is a tax billing, collections and legal case management system designed to generate & process tax bills, track collections, bankruptcies, skips, and legal cases on taxpayer liabilities of all debt types.

HD™ 2.0 | Collections® combines an easy-to-use collector interface with sophisticated management tools and blends them into a seamless environment. With the flexibility to manage billions of debtor accounts, handle thousands of users, and process accounts faster than any other platform available, it’s easy to see why HD™ 2.0 | Collections® is the most sought after collections system on the market.

HD™ 2.0 | Legal® delivers a complete legal case management & collections solution, which tracks legal cases, case parties, bankruptcies, linked cases, services, events, compliance & consent of judgment financial buckets. HD™ 2.0 | Legal® is the most powerful and widely used system for legal case management.

Growing portfolio size is what HD™ 2.0 | PM® (Portfolio Manager) was designed for. With unlimited scalability, PM consolidates your entire portfolio into a simple, easy to manage, user-friendly platform providing your organization with unified servicing practices, transparency, and increased borrower satisfaction.

HD™ 2.0 | CMS® consumer financial "Compliance Management System" (CMS) is designed to mirror CFPB, FDCPA & TCPA guidelines for state & federal compliance regulations.

HD™ 2.0 | CUBE® generates business rules sourced data sets for analytical reporting & business rules workflow processing.

HD™ 2.0 | Fusion® is a data interface communications bridge platform designed to link systems into the CSS IMPACT HD™ 2.0 ecosystem for dynamic access to external data. These external data sets are then exposed to HD™ 2.0's business rules workflow engine, data warehouse (CUBE) , & Ad hoc Report writer for data processing consumption.

HD™ 2.0 | Data Annex® is an online account annex portal designed for inter-departmental staff, field agents, or clients to manage and review accounts. HD™ 2.0 | Data Annex® is fully customizable to your organization's online branding presence.

HD™ 2.0 | Payment Portal® is an online consumer portal designed for self-serve account management, payments, negotiations & arrangements. HD™ 2.0 | Payment Portal® is fully customizable to your organization's online branding presence.

CSS's fintech consulting services cater to all financial technologies & solutions for every industry and vertical.

Get Started With CSS Impact

Sign-up and learn more about how our financial solutions can help make an impact on your bottom line.