What is a Call Center Contacts Suite?

Consumer contacts adhere to highly-regulated FDCPA & TCPA federal & state governance. To meet compliance, all call center telephony solutions must interface in real-time to the financial system of records. Although most systems may claim to be compliant, the truth is that they aren’t as they don’t truly interface in real-time.

HD™ 2.0 | Contacts® resolves this problem, by delivering a cost-effective, fully compliant, real-time integrated Dialer, IVR, & SMS solution.

It is a 100% cloud-based call center solution offering which includes Pure Contacts®; a feature rich Integrated Dialer that is a cut above the rest. Mobile Contacts®; a fully compliant manual mobile phone contacts solution, call recorder, IVR & more... HD™ 2.0 | Contacts® is the industry’s answer to the FCC’s & TCPA’s to complex consumer compliance financial contacts.

What our clients are saying...

“CSS has been an excellent partner and project leader in managing our transition to their software solution, IMPACT! HD™ 2.0”

Jeff Smejkal, Assistant Director, Bureau of Delinquent Revenue

City & County of San Francisco Office of the Treasurer & Tax Collector

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the technical-mismanagement of financial transactions where aging receivables quickly turn into bad debt & ultimately to a loss. A “Financial Ecosystem” resolves this problem, as it is a battery of proprietary fintech systems & solutions that consolidate into a single Financial Platform across your enterprise.

Problem

The FCC ruled that cell phone contacts are strictly limited to manual dialing, learn how HD™ 2.0 | Mobile Contacts® solves this problem while staying within full compliance.

Solution

What if there was a way to manually dial cell phones, maintain call performance similar to a call center dialer environment, while in compliance? Check out our video & learn how!

Some of our Tools

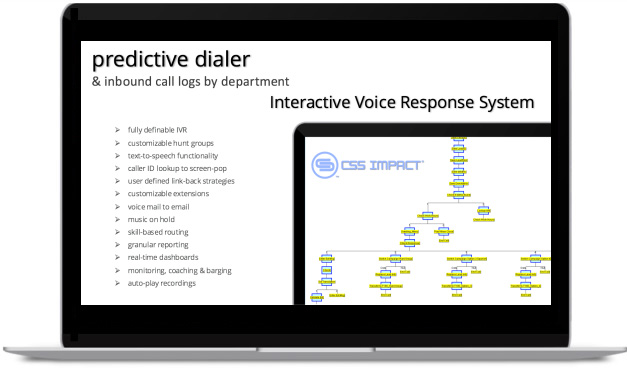

Predictive inbound/outboud call center dialer, IVR, on-the-fly cell scrubs, SMS text chat, ring-less VM drops, VM-to-email, skills based routing, text-to-speech, recordings, PBX & more…

No more campaign files!

File-less dialer campaigns! Write once, use many, that's how simple it is. Simply design a campaign, publish and reuse-- no need for recreation as our campaigns are dynamic.

HD™ 2.0 | Contacts® Platform functionality

The HD™ 2.0 | Contacts® provides efficiencies and optimization for day-to-day operations, such as:

- Click to Dial

- Power Dialing

- Predictive Inbound/Outbound Dialer

- Visual Workflow Campaigns

- ACI (Agent Call Initiator)

- Management Driven Collector Queues

- IVR Scripting & Text-to-speech

- Real-time disposition & recording updates

- Dynamic ANI Display & Routing

- Cell Phone Scrubber

- ACD & Skill Routing

- ACD Last Call

Enhance your contacts management processes with these call center solutions

Pure

HD™ 2.0 | Pure Contacts® is a fully cloud-based contacts center solution that delivers a powerful suite of visual campaign workflow tools and compliance delivering the right contact to the right party at the right time

Benefits:

- Cloud-based

- Records calls

- Records histories

- Records dispositions

- Dynamically attaches call recordings, histories, and dispositions to accounts seamlessly in real-time

- Examines system of records and locates a fully qualified account and dials in real-time with full evaluation audit trail.

- No required manual effort

- No file uploads, data downloads, recordings management, or IT maintenance.

Mobile

HD™ 2.0 | Mobile Contacts® is a fully cloud-based mobile contacts center solution that does not involve any type of dialer, robodialer, automated random or sequential dial logic equipment, or scalable technology. Instead, the platform manually dials calls, which directly connect to the telephone carrier, while still providing exceptional volumes of productivity, right party contacts, and compliance.

Benefits:

- Cloud-based

- Records calls

- Records histories

- Records dispositions

- Dynamically attaches call recordings, histories, and dispositions to accounts seamlessly in real-time

- Examines system of records and locates a fully qualified account and dials in real-time with full evaluation audit trail.

- No required manual effort

- No file uploads, data downloads, recordings management, or IT maintenance.

Suite

HD™ 2.0 | Call Center® solutions suite includes HD™ 2.0 | Pure Contacts® and HD™ 2.0 | Mobile Contacts®. Both platforms connect to the same stand-alone system of records, while remaining completely firewalled from one another, so there is no capability for the platforms to access one another even as they work collectively maintaining full FCC compliance.

Benefits:

- Fully Compliant

- Cloud-based

- Increased right party contacts

- Increased collections revenue

- Streamlined business processes

- Heightened productivity and efficiency.

- No required manual effort

- No file uploads, data downloads, recordings management, or IT maintenance.

HD™ 2.0 | Contacts® serves business types of all sizes, efficientlystreamlining processes to generate maximum revenue at minimum cost

No matter the type or size of your organization, if you need a contacts management solution, HD™ 2.0 | Contacts® is your answer.

Business Types

Business Types

Call Centers

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® provides a complete set of Call Center-specific functions. Whether your call center is Inbound, Outbound, Multichannel, or Blended, HD™ 2.0 | Contacts® call center solution provides the most premium features available, including but not limited to:

Benefits:

- No agent wait-time whatsoever

- Fully integrated with platform

- Full compliance and compliance breach protection

- Elimination of file uploads, downloads, and the need for manual updates

- Highest voice quality

- Built-in visual live dashboard analytics

- Separate platforms for landlines and mobile phones, but work in unison

Collection Agencies

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® offers a complete set of collection agency-specific functions, including but not limited to:

Benefits:

- Agent-caller matching

- Dynamic call recording and attachment to account

- Instant caller account screen pop

- Right Party Contact each and every time

- Zero agent wait time

- Perpetually fresh account information

- Direct integration to collections platform

- Full compliance protection in real-time

- Elimination of file uploads, downloads, and the need for manual updates

Legal Firms

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® provides a complete set of legal firm-specific functions, including but not limited to:

Benefits:

- Fully integrated with platform

- Dynamic call recording and attachment to account

- Instant caller account screen pop

- Zero caller wait time

- Fully compliant contacts suite

- Compliance breach protection

- Call notes and histories

Banks

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® provides a complete set of bank-specific functions, including but not limited to:

Benefits:

- Cloud-based

- Direct integration with platform

- Dynamic call recording and attachment to account

- No caller wait-time whatsoever

- Instant caller account screen pop

- Fully compliant contacts suite

- Compliance breach protection

Government & Municipalities

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® provides a complete set of government & municipality-specific functions, including but not limited to:

Benefits:

- Automated messaging

- Compliant Right Party Contact each and every time

- No caller wait-time whatsoever

- Cloud-based

- Fully integrated with platform

- Fully compliant system

- Compliance breach protection

- Elimination of file uploads, downloads, and the need for manual updates

- Highest voice quality

- Built-in visual live dashboard analytics

- Separate platforms for landlines and mobile phones that work in unison

Loan Servicing Companies

In addition to core contacts center management functionality, HD™ 2.0 | Contacts® provides a complete set of government & municipality-specific functions, including but not limited to:

Benefits:

- Agent-caller matching

- Dynamic call recording and attachment to account

- Instant caller account screen pop

- Right Party Contact each and every time

- Zero agent wait time

- Perpetually fresh account information

- Direct integration to collections platform

- Full compliance protection in real-time

- Elimination of file uploads, downloads, and the need for manual updates

User Types

User Types

Agents & Administrators

Agents & Administrators

HD™ 2.0 | Contacts® helps agents and administrators at all levels make compliant contacts both on landline and mobile numbers effectively and efficiently.

- Tracks number of contact attempts

- Real-time time-zone compliance

- All relevant data presented on a single screen

- Real-time compliance breach prevention

- FCC compliant

- Sensitive data obfuscation

Technology Staff

Technology Staff

Whether you’re the organization's Chief Information Officer, IT Director, or IT Manager, supporting a contacts system that is manageable, adaptable, and secure is your number one priority. HD™ 2.0 | Contacts® offers key technology features to assist such as:

- Open Web Services Library – Allows IT staff to compress implementation time and support current and new third-party partners without relying on the vendor.

- Ad Hoc Reporting Toolkit – Allows staff to independently construct new custom reports on demand without relying on the vendor.

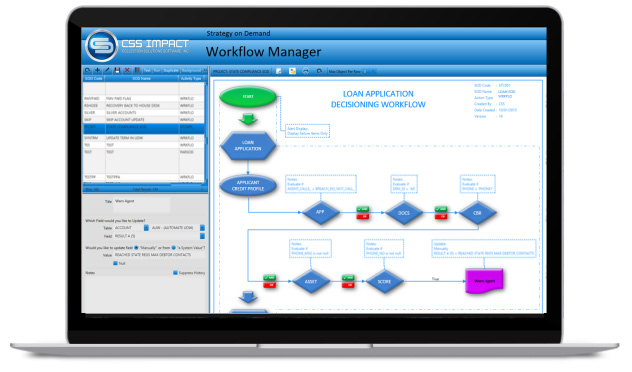

- Visual Rules Engine Workflow Manager – Automates the execution of systematic actions based on bureau and consumer provided data enabling non-technical and IT staff to manage business rules and data values.

- Configuration Manager – Allows non-technical and IT staff to tailor code their own windows, workflows, reports, dashboards, and values as well as data lookup tables in a simple user-friendly and dynamic environment.

HD™ 2.0 | Contacts® Support

Our customer service team has extensive experience in contacts center solutions and financial technology, business analysis, project management, user training, and software development. They understand the entire process, key issues and challenges, and can help save you time and reduce risk with support at implementation and beyond.

Dedicated project manager

As a HD™ 2.0 | Contacts® customer, you’ll have a CSS consultant as your single point of contact – committed to helping your organization get the most out of your call center platform.

Automatic system upgrades and maintenance

Our engineers and analysts continually build and improve on an already superior product – with upgrades and maintenance automatically applied for hassle-free operation.

Experienced, knowledgeable support staff

Our experienced customer support team understands the complexities of call center solutions, so they make sure everything – from implementation to training – goes smoothly with minimal disruption.

What is a Financial Ecosystem?

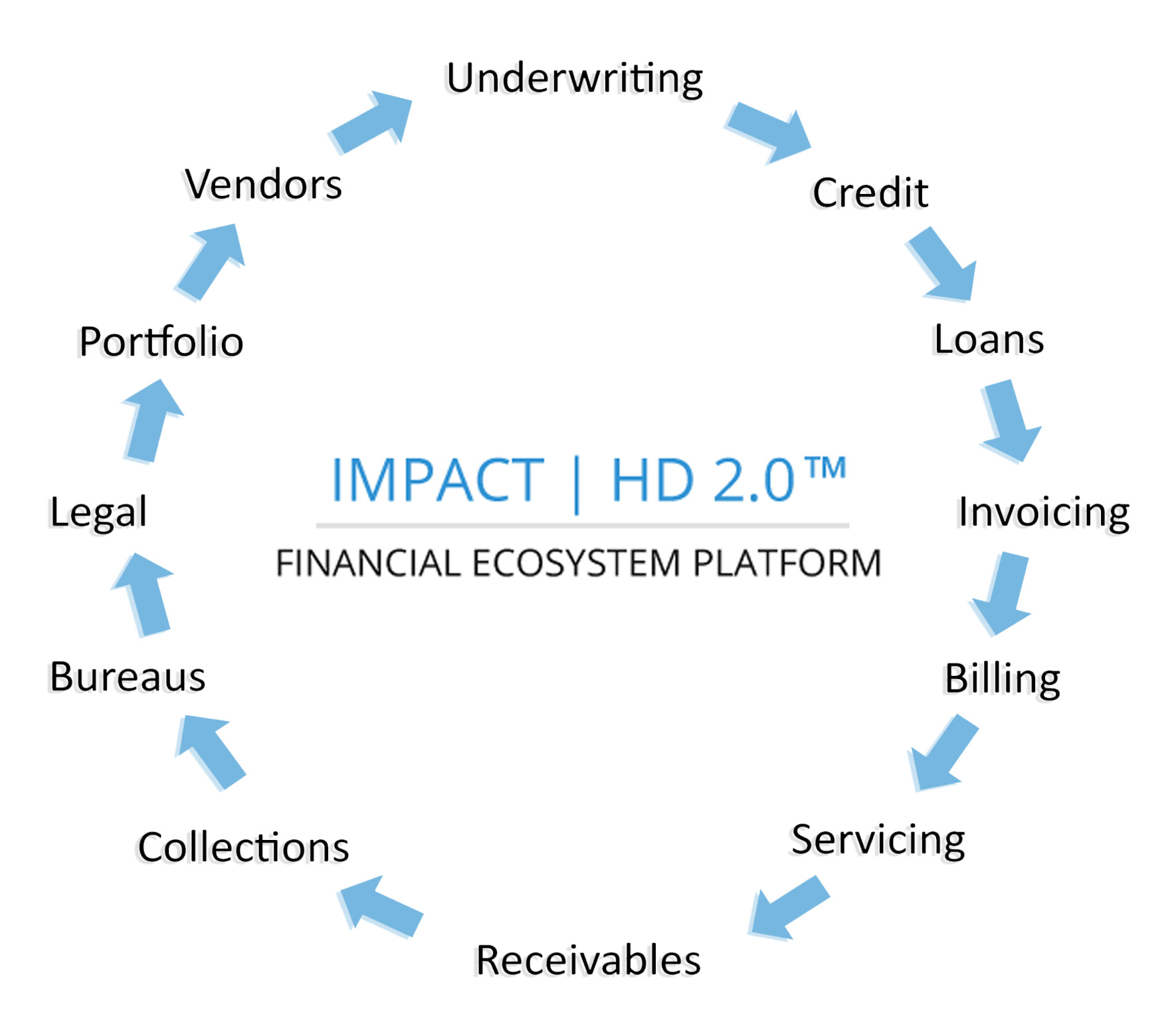

Billions of dollars are lost annually due to the inadequate adoption of fintech technology for financial transactions management whereby mismanaged, aging receivables quickly turn revenues into bad debt and ultimately into losses. The primary reason for this outcome is the lack of a single enterprise solution that can manage every aspect of the revenue management life cycle process across all business units in unison.

Traditional platforms are stand-alone, independent systems that don't share common technology & can’t communicate dynamically with one another, leaving business units separated. This leaves entities with old, stale financial data, making it impossible to both manage aging receivables & avoid uncollectable debt. A Financial Ecosystem resolves this problem. A Financial Ecosystem is a battery of highly sophisticated proprietary fintech systems & solutions that consolidate into one single Financial Platform across your enterprise. HD™ 2.0 | Enterprise Financial Ecosystem® is that end-to-end financial platform that manages your revenues and receivables, while safeguarding bad debt exposure.

Parts of a Financial Ecosystem

HD™ 2.0 | LMS® Loan Management System (LMS) enables credit grantors & servicers to create business rules for underwriting decisioning workflows simply & visually without the need of complicated coding. LMS can systematically control financial screen navigation, input/output, verbose messaging and database interactions from any internal or external system or framework.

Now, when new applications for underwriting are introduced, they are first “interrogated” by the LMS business rules engine, which then gives a “thumbs up, thumbs down” decision.

This approach enables organizations to evaluate the application against multiple internal or external data sources and predict which applications should be manually reviewed, versus those that are most expected to contain appropriate information for automatic underwriting.

HD™ 2.0 | LMS® offers:

- Automation of manual procedures and calculations: By utilizing an automated analytic-based underwriting system, the consistency, quality and capacity of underwriting could be dramatically improved, allowing underwriters to focus on the exceptions.

- Control by business users: Rules are designed in an easy-to-understand visual Visio-like workflow designer, enabling the business experts— rather than technical staff—to control and automate procedures and policies.

- Faster response to change: Time-to-market for business logic changes are reduced from weeks and months to days or hours. Systems can be updated while in production with no down time and no need for IT resources.

- Increased reliability and auditability: A centralized workflow decisioning rules repository provides consistent execution of business policies that are easy to manage and visually easy to audit.

HD™ 2.0 | LMS® business rules engine allows for the development and rapid deployment of complex credit granting business rules, so your organization can make better decisions across the Revenue Life Cycle. Automate and optimize numerous types of business decisions, including credit approve/decline, instant prescreen offers, and collection decisions.

With HD™ 2.0 | LMS® you can also systematically analyze scoring, business rules and decision strategies from external data systems. This enables continuous testing and fine tuning of your business rules, so you can optimize decision strategies to drive higher profits.

- Pull data from multiple sources — both internal and external — into your decisioning engine dynamically.

- Process a high volume of transactions, with support and availability 24 hours a day

- Gain the ability to calculate numerous predictive attributes with self-designed scoring models

- Test new strategies against your current decision models and perform what-if simulations on historical data

- Improve business process efficiencies with continuous-loop deployment of enhanced and optimized decision strategies

- Deploy new decisioning strategies dynamically, to respond to market changes rapidly

- Deliver dynamic real-time, instant decisions while customers are at the point of sale

- Seamlessly integrate LMS's workflow decisioning engine into your existing systems with minimal IT costs

HD™ 2.0 | LMS® is specially designed to simplify and automate all loan processes from start to finish. This intelligent solution shepherds the user through each phase of the loan servicing process, presents the freshest data in real-time, and intuitively computes all calculations providing the easiest user-experience available anywhere.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver a salient automated enterprise invoicing solution. Generate business rules-driven invoicing with a built-in document management system. Offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

Give your customers what they want with customer-centric invoicing and payment options. Shorten your revenue cycle with a multitude of automated payment and invoicing technology solutions and easily track partial payments and past due invoices.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver an automated rules-driven billing solution across the enterprise. Seamlessly retrieve documents, contracts, and offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

With over 300+ modules dedicated to billing in real-time, HD™ 2.0 | RMS® provides the most comprehensive, state of the art tools to meet all your billing needs. With unparalleled automation, RMS minimizes training while maximizing production.

HD™ 2.0 | RMS® Receivables Management System (RMS) presents the most sophisticated tool set available for account receivables management, adaptable for any business or organization type. With capabilities to tie into the HD™ 2.0 Enterprise Financial Ecosystem, you can confidently expand your offerings across multiple industries and verticals for geometric growth.

HD™ 2.0 | RCM® is a healthcare Revenue Cycle Management (RCM) system designed to manage claim submissions, self-pay & insurer billing & recoveries.

HD™ 2.0 | TAX® is a tax billing, collections and legal case management system designed to generate & process tax bills, track collections, bankruptcies, skips, and legal cases on taxpayer liabilities of all debt types.

HD™ 2.0 | Collections® combines an easy-to-use collector interface with sophisticated management tools and blends them into a seamless environment. With the flexibility to manage billions of debtor accounts, handle thousands of users, and process accounts faster than any other platform available, it’s easy to see why HD™ 2.0 | Collections® is the most sought after collections system on the market.

HD™ 2.0 | Legal® delivers a complete legal case management & collections solution, which tracks legal cases, case parties, bankruptcies, linked cases, services, events, compliance & consent of judgment financial buckets. HD™ 2.0 | Legal® is the most powerful and widely used system for legal case management.

Growing portfolio size is what HD™ 2.0 | PM® (Portfolio Manager) was designed for. With unlimited scalability, PM consolidates your entire portfolio into a simple, easy to manage, user-friendly platform providing your organization with unified servicing practices, transparency, and increased borrower satisfaction.

HD™ 2.0 | CMS® consumer financial "Compliance Management System" (CMS) is designed to mirror CFPB, FDCPA & TCPA guidelines for state & federal compliance regulations.

HD™ 2.0 | CUBE® generates business rules sourced data sets for analytical reporting & business rules workflow processing.

HD™ 2.0 | Fusion® is a data interface communications bridge platform designed to link systems into the CSS IMPACT HD™ 2.0 ecosystem for dynamic access to external data. These external data sets are then exposed to HD™ 2.0's business rules workflow engine, data warehouse (CUBE) , & Ad hoc Report writer for data processing consumption.

HD™ 2.0 | Data Annex® is an online account annex portal designed for inter-departmental staff, field agents, or clients to manage and review accounts. HD™ 2.0 | Data Annex® is fully customizable to your organization's online branding presence.

HD™ 2.0 | Payment Portal® is an online consumer portal designed for self-serve account management, payments, negotiations & arrangements. HD™ 2.0 | Payment Portal® is fully customizable to your organization's online branding presence.

CSS's fintech consulting services cater to all financial technologies & solutions for every industry and vertical.

Get Started With CSS Impact

Sign-up and learn more about how our financial solutions can help make an impact on your bottom line.