What is a Loan Management System?

Traditionally, organizations have stand-alone systems for underwriting, servicing, receivables, & collections that can’t interact with one another in real-time leaving business units exposed to stale financial data ultimately turning receivables into uncollectable debt. What if there was an enterprise-level loan management software that unified all of your financial data into one system?

HD™ 2.0 | LMS® is an enhanced loan origination software that offers proprietary fintech technology for credit grantors & servicers, delivering an all-in-one front-to-back-office “Loan Management System” (LMS) that automates originations, credit granting, servicing, collections, legal and portfolio management while virtually eliminating debt. Our loan management software does it all, so you can focus on growth and running your business.

What our clients are saying...

“As with a transition to any system, there is a learning curve, but CSS has stood by us through the entire process and really worked to understand our workflow process and

then help configure the platform to match our internal needs and strategies. They offer

on-line chat and basically support us 24-7. Quite honestly, I was a bit surprised with the

quality and access to support given our past experiences with other vendors.”

Brian Moore, Partner

Drew, Eckl, Farnham

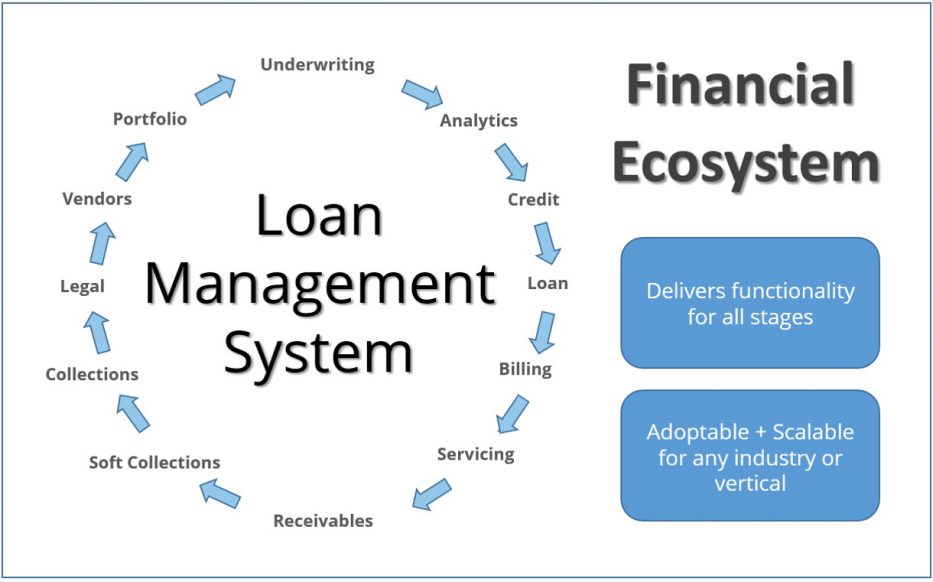

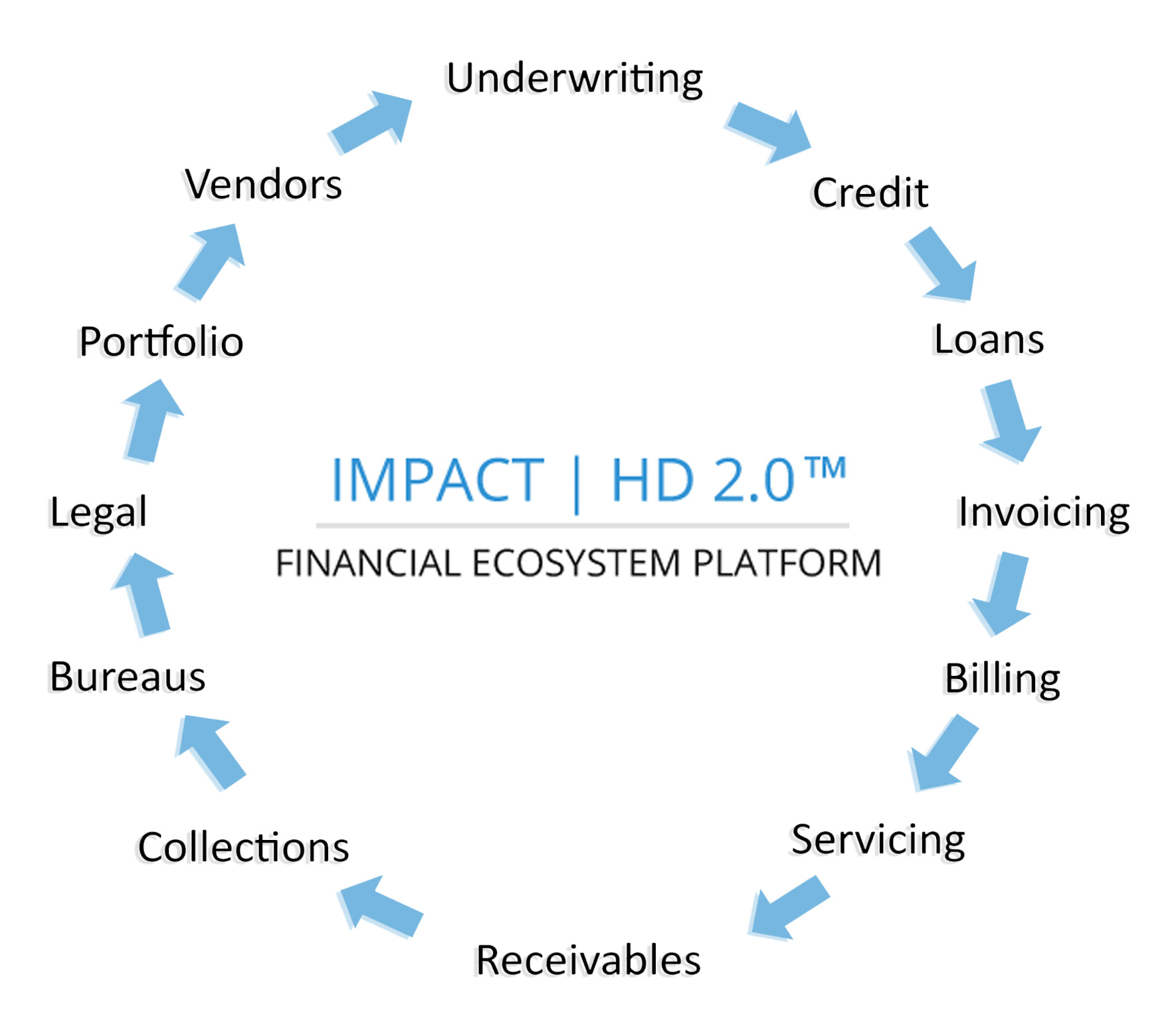

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the technical mismanagement of financial transactions where aging receivables quickly turn into bad debt & ultimately to a loss. A “Financial Ecosystem” resolves this problem, as it is a battery of proprietary fintech systems & solutions that consolidate into a single Financial Platform across your enterprise.

Evolve with technology

We are continuously developing new & exciting fintech platforms that interface with global financial ecosystems worldwide minimizing credit risks while maximizing revenues.

Transparency is kingDynamic dashboard analytics

HD™ 2.0 | LMS® delivers the necessary visibility to provide effective revenue performance transparency engendering geometric financial growth.

Simplify your work load

Design scoring workflows that govern underwriting & servicing decisions giving creditors the ability to mitigate credit risks & automate servicing processing.

Accelerate decisions

Accelerate lending decisions with HD™ 2.0 | LMS® and start making decisions in hours rather than days, improving customer experience while maximizing opportunity.

HD™ 2.0 | LMS® Loan Management System functionality

The HD™ 2.0 | LMS® loan management software system provides efficiencies and optimization for day-to-day operations, such as:

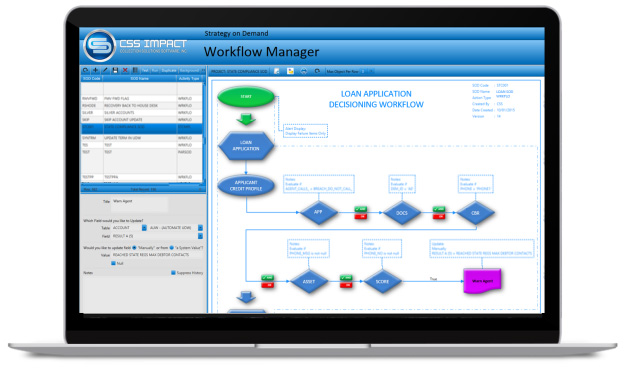

- Advanced Visual Workflows

- Consumer Facing Portals

- Analytics & Dashboards

- Bureau Information Gathering

- Origination Workflows Engine

- Loan Servicing Rules Engine

- Billing & Notices

- Ad Hoc Reports

- Financial Regulatory Compliance

- Document Management System

- Auto-calculated Funding Payables

- Automated Transaction Workflows

Enhance your loan origination & loan servicing process with these solutions

Originations

HD™ 2.0 | LMS® Loan Management Software System creates an easy-to-use, streamlined loan origination and loan servicing process which offers key component features for every phase.

Benefits:

- Automated originations process

- Auto approvals, declines & conditions

- Application decisioning & stipulations

- Payment calculation estimates

- Integrated loan billing & servicing

- Auto approvals, declines & conditions

- Integrated collections

- Integrated Legal System

- Vendor Management

- Payment Portal

- Loan history tracking

- Required enrollment

- Automatic payment enrollment offerings

- Paperless funding checklist

- Consolidated multi-loan funding

Decisioning

HD™ 2.0 | LMS® tracks and manages accurately decisioning workflows of consumed integrated in-house internal data & outsourced external information sources.

Benefits:

- Intuitive visual workflow interface

- Collaboratively share & reuse rule flows and object models

- Easily write, edit & test workflow rules

- Business users have complete control of rule creation and management

- 500% faster than competitive engines at the highest levels of complexity

Integration

HD™ 2.0 | LMS® tracks and manages accurately decisioning workflows of consumed integrated in-house internal data & outsourced external information sources.

Benefits:

- Ease of integration with analytics for fast deployment of predicative models

- Decision simulator provides visibility to quickly simulate the potential business impact scenarios of new rules prior to moving them into production

- Deploy & execute rules in multiple platforms dynamically

- Intuitive web executable interface that provides business user centric decision authoring, testing and deployment and integrates with a wide range of other technologies such as WebSphere, JBOSS and WebLogic

- Integrate to any data source or repository seamlessly

HD™ 2.0 | LMS® helps loan originators & credit grantors of all typeseffectively serve their clients

Whether you underwrite loans, credit lines, mortgages or have a supporting role in the origination process, or interact with loan officers & consumers on a regular basis, HD™ 2.0 | LMS® helps you work more efficiently.

Business types

Business types

Banking

HD™ 2.0 | LMS® provides a complete set of banking-specific origination functions for:

Benefits:

- Consumer loans

- Business loans

- Commercial loans

- Home loans

- Home equity loans

- Home equity lines of credit

Retail

For specialty retailers that provide in-house credit HD™ 2.0| LMS® has additional functionality for underwriting:

Benefits:

- Consumer loans

- Revolving credit

- Short term loans

- Store credit management

Automotive

HD™ 2.0 | LMS® includes the core functionality for the automotive industry, with added features and functionality specific to fast-paced, high-volume loan origination processing needs.

- Secured loans

- Unsecured loans

- Pre-computed interest loans

- Simple interest loans

User Types

User Types

Underwriters & Credit Grantors

Underwriters & Credit Grantors

HD™ 2.0 | LMS® helps credit grantors at all levels and underwriters manage account information accurately through effective and efficient loan processing – regardless of the type of loan being processed.

Technology Staff

Technology Staff

Whether you’re the organization's Chief Information Officer, IT Director, or IT Manager, supporting a Loan Origination & servicing system that is manageable, adaptable, and secure is your number one priority. HD™ 2.0 | LMS® offers key technology features to assist such as:

- Open Web Services Library – Allows IT staff to compress implementation time and support current and new third-party partners without relying on the vendor.

- Ad Hoc Reporting Toolkit – Allows credit grantors staff to independently construct new custom reports on demand without relying on the vendor.

- Visual Rules Engine Workflow Manager – Automates the execution of systematic actions based on bureau and consumer provided data enabling non-technical finance and IT staff to manage business rules and data values.

- Configuration Manager – Allows non-technical firm and IT staff to tailor code their own windows, workflows, reports, dashboards, and values as well as data lookup tables such as accounts, loan types, contracts procurement, loan events, tasks, calendars, and loan data grids in a simple user-friendly and dynamic environment.

HD™ 2.0 | LMS® Support

Our customer service team has extensive experience in loan origination technology & loan servicing processes, business analysis, project management, user training, and software development. They understand the underwriting process, key issues and challenges, and can help save you time and reduce risk with support at implementation and beyond.

Dedicated project manager

As a HD™ 2.0 | LMS® customer, you’ll have a CSS consultant as your single point of contact – committed to helping your organization get the most out of your loan origination system.

Automatic system upgrades and maintenance

Our engineers and analysts continually build and improve on an already superior product – with upgrades and maintenance automatically applied for hassle-free operation.

Experienced, knowledgeable support staff

Our experienced customer support team understands the complexities of loan underwriting and origination operations. So they make sure everything – from implementation to training – goes smoothly with minimal disruption.

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the inadequate adoption of fintech technology for financial transactions management whereby mismanaged, aging receivables quickly turn revenues into bad debt and ultimately into losses. The primary reason for this outcome is the lack of a single enterprise solution that can manage every aspect of the revenue management life cycle process across all business units in unison.

Traditional platforms are stand-alone, independent systems that don't share common technology & can’t communicate dynamically with one another, leaving business units separated. This leaves entities with old, stale financial data, making it impossible to both manage aging receivables & avoid uncollectable debt. A Financial Ecosystem resolves this problem. A Financial Ecosystem is a battery of highly sophisticated proprietary fintech systems & solutions that consolidate into one single Financial Platform across your enterprise. HD™ 2.0 | Enterprise Financial Ecosystem® is that end-to-end financial platform that manages your revenues and receivables, while safeguarding bad debt exposure.

Parts of a Financial Ecosystem

HD™ 2.0 | LMS® Loan Management System (LMS) enables credit grantors & servicers to create business rules for underwriting decisioning workflows simply & visually without the need of complicated coding. LMS can systematically control financial screen navigation, input/output, verbose messaging and database interactions from any internal or external system or framework.

Now, when new applications for underwriting are introduced, they are first “interrogated” by the LMS business rules engine, which then gives a “thumbs up, thumbs down” decision.

This approach enables organizations to evaluate the application against multiple internal or external data sources and predict which applications should be manually reviewed, versus those that are most expected to contain appropriate information for automatic underwriting.

HD™ 2.0 | LMS® offers:

- Automation of manual procedures and calculations: By utilizing an automated analytic-based underwriting system, the consistency, quality and capacity of underwriting could be dramatically improved, allowing underwriters to focus on the exceptions.

- Control by business users: Rules are designed in an easy-to-understand visual Visio-like workflow designer, enabling the business experts— rather than technical staff—to control and automate procedures and policies.

- Faster response to change: Time-to-market for business logic changes are reduced from weeks and months to days or hours. Systems can be updated while in production with no down time and no need for IT resources.

- Increased reliability and auditability: A centralized workflow decisioning rules repository provides consistent execution of business policies that are easy to manage and visually easy to audit.

HD™ 2.0 | LMS® business rules engine allows for the development and rapid deployment of complex credit granting business rules, so your organization can make better decisions across the Revenue Life Cycle. Automate and optimize numerous types of business decisions, including credit approve/decline, instant prescreen offers, and collection decisions.

With HD™ 2.0 | LMS® you can also systematically analyze scoring, business rules and decision strategies from external data systems. This enables continuous testing and fine tuning of your business rules, so you can optimize decision strategies to drive higher profits.

- Pull data from multiple sources — both internal and external — into your decisioning engine dynamically.

- Process a high volume of transactions, with support and availability 24 hours a day

- Gain the ability to calculate numerous predictive attributes with self-designed scoring models

- Test new strategies against your current decision models and perform what-if simulations on historical data

- Improve business process efficiencies with continuous-loop deployment of enhanced and optimized decision strategies

- Deploy new decisioning strategies dynamically, to respond to market changes rapidly

- Deliver dynamic real-time, instant decisions while customers are at the point of sale

- Seamlessly integrate LMS's workflow decisioning engine into your existing systems with minimal IT costs

HD™ 2.0 | LMS® is specially designed to simplify and automate all loan processes from start to finish. This intelligent solution shepherds the user through each phase of the loan servicing process, presents the freshest data in real-time, and intuitively computes all calculations providing the easiest user-experience available anywhere.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver a salient automated enterprise invoicing solution. Generate business rules-driven invoicing with a built-in document management system. Offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

Give your customers what they want with customer-centric invoicing and payment options. Shorten your revenue cycle with a multitude of automated payment and invoicing technology solutions and easily track partial payments and past due invoices.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver an automated rules-driven billing solution across the enterprise. Seamlessly retrieve documents, contracts, and offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

With over 300+ modules dedicated to billing in real-time, HD™ 2.0 | RMS® provides the most comprehensive, state of the art tools to meet all your billing needs. With unparalleled automation, RMS minimizes training while maximizing production.

HD™ 2.0 | RMS® Receivables Management System (RMS) presents the most sophisticated tool set available for account receivables management, adaptable for any business or organization type. With capabilities to tie into the HD™ 2.0 Enterprise Financial Ecosystem, you can confidently expand your offerings across multiple industries and verticals for geometric growth.

HD™ 2.0 | RCM® is a healthcare Revenue Cycle Management (RCM) system designed to manage claim submissions, self-pay & insurer billing & recoveries.

HD™ 2.0 | TAX® is a tax billing, collections and legal case management system designed to generate & process tax bills, track collections, bankruptcies, skips, and legal cases on taxpayer liabilities of all debt types.

HD™ 2.0 | Collections® combines an easy-to-use collector interface with sophisticated management tools and blends them into a seamless environment. With the flexibility to manage billions of debtor accounts, handle thousands of users, and process accounts faster than any other platform available, it’s easy to see why HD™ 2.0 | Collections® is the most sought after collections system on the market.

HD™ 2.0 | Legal® delivers a complete legal case management & collections solution, which tracks legal cases, case parties, bankruptcies, linked cases, services, events, compliance & consent of judgment financial buckets. HD™ 2.0 | Legal® is the most powerful and widely used system for legal case management.

Growing portfolio size is what HD™ 2.0 | PM® (Portfolio Manager) was designed for. With unlimited scalability, PM consolidates your entire portfolio into a simple, easy to manage, user-friendly platform providing your organization with unified servicing practices, transparency, and increased borrower satisfaction.

HD™ 2.0 | CMS® consumer financial "Compliance Management System" (CMS) is designed to mirror CFPB, FDCPA & TCPA guidelines for state & federal compliance regulations.

HD™ 2.0 | CUBE® generates business rules sourced data sets for analytical reporting & business rules workflow processing.

HD™ 2.0 | Fusion® is a data interface communications bridge platform designed to link systems into the CSS IMPACT HD™ 2.0 ecosystem for dynamic access to external data. These external data sets are then exposed to HD™ 2.0's business rules workflow engine, data warehouse (CUBE) , & Ad hoc Report writer for data processing consumption.

HD™ 2.0 | Data Annex® is an online account annex portal designed for inter-departmental staff, field agents, or clients to manage and review accounts. HD™ 2.0 | Data Annex® is fully customizable to your organization's online branding presence.

HD™ 2.0 | Payment Portal® is an online consumer portal designed for self-serve account management, payments, negotiations & arrangements. HD™ 2.0 | Payment Portal® is fully customizable to your organization's online branding presence.

CSS's fintech consulting services cater to all financial technologies & solutions for every industry and vertical.

Get Started With CSS Impact

Sign-up and learn more about how our financial solutions can help make an impact on your bottom line.