Efficiently optimize your Revenue Cycle process and Lower AR Days

HD™ 2.0 | RCM® is a comprehensive, cloud-based revenue cycle management software that features a medical billing and recovery system designed to help you better manage your Revenue Cycle, so you can process claims, bill and collect faster and more efficiently.

HD™ 2.0 | RCM® software offers tools for managing Self-Pay Recoveries, Third-Party Liability, Standard Personal Injury, Creditor Claims, Health Insurance/IPA, Legal Actions & Case Management, as well as everything a healthcare provider needs to do their work more effectively and efficiently.

What our clients are saying...

“I would like to thank CSS Impact for organizing a users conference in Amelia Island, Fl. It was great.”

Christina Lynn Rioux, Senior Vice President of Third Party Operations/CCO

Credit Solutions LLC

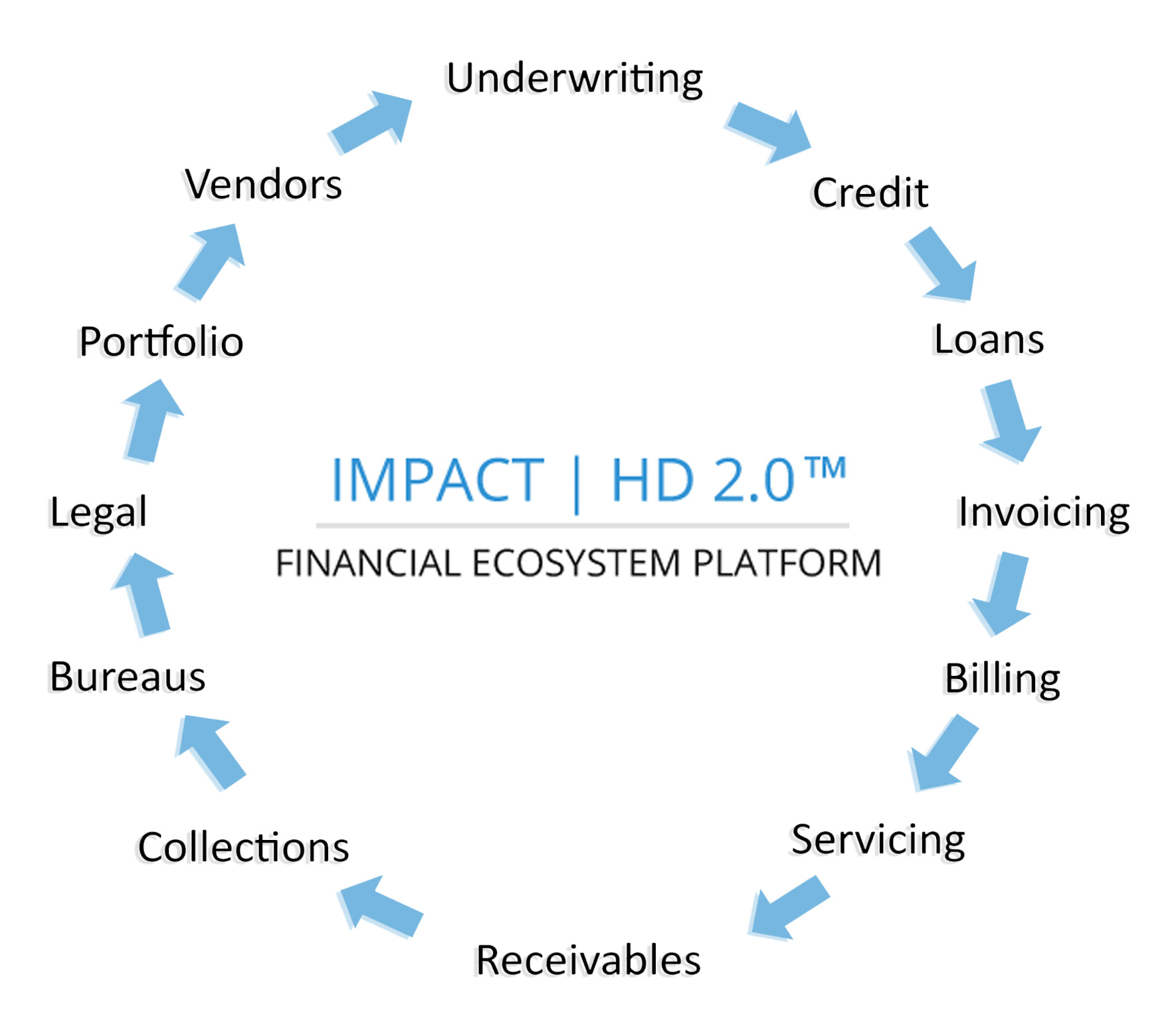

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the technical mismanagement of financial transactions where aging receivables quickly turn into bad debt & ultimately to a loss. A “Financial Ecosystem” resolves this problem, as it is a battery of proprietary fintech systems & solutions that consolidate into a single Financial Platform across your enterprise.

For healthcare providers

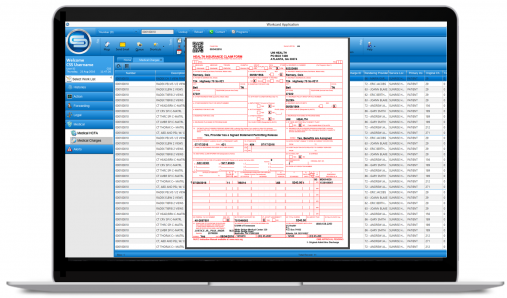

HD™ 2.0 | RCM® revenue cycle management software auto-generates electronic claims in standard claim forms, such as CMS 1500, the UB04 and the ADA 2012 - respectively, as well as the data processing of 837 & 835 electronic files.

Intuitive claims workflow

HD™ 2.0 | RCM® enables precise account workflows that manage, audit, evaluate and compare claim benefits for providers/payers, as well as for revenue management recovery units.

For health issuers and payers

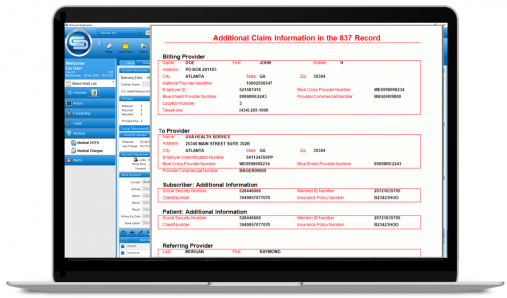

Receive & process 837 electronic billings, systematically audit submitted billings & benefits, plus auto-generate electronic 835 transaction payments.

Turn-key revenue cycle solution

HD™ 2.0 | RCM® is a complete solution that encompasses every function to manage the entire revenue cycle process.

HD™ 2.0 | RCM® functionality

The HD™2.0 | RCM® system provides efficiencies and optimization for day-to-day operations for your revenue cycle, such as:

- Patient Engagement

- Customized Business Rules

- Healthcare Compliance

- Patient Portals

- Insurance Billing

- Self-Pay Billing

- Third Party Liability

- Early Out

- Legal Case Management

- Insurance Subrogation

- Audit Benefits & Recoveries

- Facility Accounting Consolidations

Effectively process accounts to maximize revenue with these solutions

Providers

The HD™ 2.0 | RCM® revenue cycle software system creates an easy-to-use, streamlined healthcare account management process, which offers key component features for every phase including billing and tracking of insurance claims, process billing statements, send soft collections notices, push accounts to your internal collections unit or take advantage of our built-in collections agency forwarding and vendor management system--all from one screen.

Benefits:

- Patient statements

- Claims tracking

- Medical charges tracking

- Batch patient billing

- Process credit cards

- Online patient & provider portals

- Built-in collections platform

- Subrogation system

- Reimbursement module

- Liens & SOL tracking

- Automated electronic remittance and payment modules

Insurers

HD™ 2.0 | RCM® provides insurers all the necessary tools and functionality to effortlessly and accurately manage remitted claims.

Benefits:

- Benefits management reconciliation

- Store & preview professional claims (CMS-1500)

- Store & preview institutional claims (UB04)

- Financial compliance

- Facility Account Consolidation Module

- Document management system

- Remittance automation

- EDIs 835/837 electronic processing

- Account linking

- Bad debt placement tracking

- Job Scheduler

- Agent driven queues

- Write-off and collection agency file builder

Early Out

HD™ 2.0 | RCM® gives your organization the appropriate total turn-key solution to manage Early Out accounts in a smooth and efficient manner.

Benefits:

- Patient De-Duping

- Account Tracking

- 1st to 3rd Party Roll

- HIPAA Security Compliance Management

Legal/TPL

HD™ 2.0 | RCM® stores, tracks and archives all legal and third-party liability case information in a secure and organized manner so they can easily be documented and processed methodically and professionally.

Benefits:

- Third-Party Liability Claim Tracking

- Insurance Compliance

- ICD9/ICD10 codes

- Litigation

- Legal Case Management

Integration

HD™ 2.0 | RCM® can process claim statuses & parses the information in a 276 claim status request file & respond via our EDI system packaging up into a 277 EDI file that is sent back to the requester.

Electronic Claim Status System:

- Creates 270 electronic requests

- Manage 271 eligibility responses

- Combines requests and responses

- Supports database integration

- Document management

- Third-party vendor

- Call recording and attachment

- Patient Portals

- Online Portals

Security

HD™ 2.0 | RCM® Healthcare cloud services is a fully secure, true enterprise data platform. Not only PCI and HIPAA compliant, but HD™ 2.0 | RCM® also offers ISO27001, SSAE 16 Type II, and fully redundant back up centers for disaster recovery. Also within the program are role based security options to ensure no sensitive data can be accessed without proper security clearances.

Benefits:

- HIPAA Compliant

- PCI Compliant

- ISO27001

- SSAE 16 Type II

- Role-based Security Levels

- User Access Level Security Codes

HD™ 2.0 | RCM® helps organizations of all types effectively serve their clients

Whether you process or manage accounts, have a supporting role in the workflow, or interact with clients on a regular basis, HD™ 2.0 | RCM® helps you work more efficiently.

Healthcare Solutions

Healthcare Solutions

Providers

HD™ 2.0 | RCM® provides a complete set of healthcare provider functions:

Benefits:

- Medical billing

- Benefits management

- Claims management

- Automated decisioning systems

- Soft collections

- Collections

- Vendor management

- Patient interactions

- Facility tracking

- Insurance tracking

- IVR automation

- Patient and facility portals

- Reports & dashboards

Insurers

HD™ 2.0 | RCM® provides a complete set of health insurer functions, such as:

Benefits:

- Benefits management

- Claims management

- Claim denial audits

- Electronic transmissions

- Facility tracking

- Insurance tracking

- Automated decisioning systems

Billers

HD™ 2.0 | RCM® provides a complete set of medical billing agency functions:

Benefits:

- Medical billing

- Benefits management

- Claims management

- Self-pay and claim denials

- Automated decisioning systems

- Soft collections

- Collections

- Vendor management

- Patient interactions

- Facility tracking

- Insurance tracking

- IVR automation

- Patient and facility portals

- Reports & dashboards

Collections

HD™ 2.0 | RCM® provides a complete set of medical recovery & collections agency functions:

Benefits:

- Medical billing

- Benefits management

- Claims management

- Self-pay and claim denials

- Automated decisioning systems

- Charity

- Soft Collections

- Collections

- Early out

- Third party liability

- Legal, subrogation & liens

- Vendor management

- Patient interactions

- Facility tracking

- Insurance tracking

- IVR automation

- Patient and facility portals

- Reports & dashboards

User Types

User Types

Medical Billers

Medical Billers

HD™ 2.0 | RCM® helps medical billers at all levels and enables administrators to manage the claim processing process accurately through our effective and efficient medical claim management system. Eliminate manual efforts and streamline operational processes with tools, such as:

- Automated billing

- Electronic transmittals

- Vendor management

- Interactive Voice Recognition system

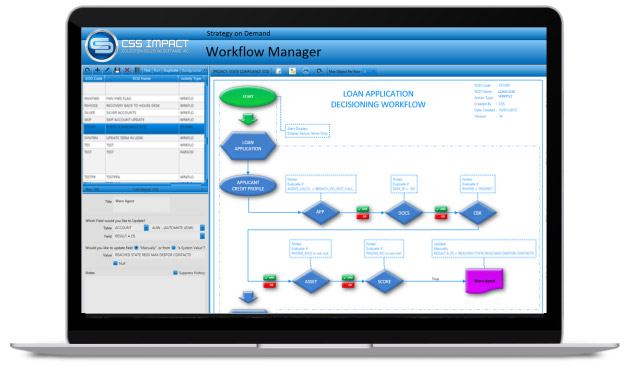

- Implementing HD™ 2.0's decisioning workflow engine

- Managing claim resubmittals, customized reports & dashboards

- Collections

- Collections forwarding

- Write-offs

Insurers

Insurers

HD™ 2.0 | RCM® revenue cycle management software provides tools and modules to process claim submissions and eliminate manual efforts, as well as streamline operational processes by:

- Automating claim benefits

- Managing claim remittances

- Offering self-serve online portals

- Implementing HD™ 2.0's decisioning workflow engine

- Procuring HD™ 2.0's IVR

- Managing claim resubmittals

- Customized reports & dashboards

- Collections

- Collections forwarding

- Write-offs

Technology Staff

Technology Staff

Whether you’re the organization's Chief Information Officer, IT Director, or IT Manager, supporting a revenue cycle management system that is manageable, adaptable and secure is your key priority. HD™ 2.0 | RCM® features:

- Open Web Services Library – Allows IT staff to compress implementation time and support current and new third-party partners without relying on the vendor.

- Ad Hoc Reporting Toolkit – Allows staff to independently construct new custom reports on demand without relying on the vendor.

- Visual Rules Engine Workflow Manager – Automates the execution of actions based on account provided data and allows non-technical and IT staff to manage business rules and data values.

- Configuration Manager – Allows non-technical firm and IT staff to tailor code their own windows, workflows, reports, dashboards and values as well as data lookup tables such as accounts, bankruptcies, events, tasks, calendars and data grids in a simple user-friendly and dynamic environment.

HD™ 2.0 | RCM® Support

Our customer service team has extensive experience in healthcare technology, case management processes, business analysis, project management, user training and software development. They understand the process, key issues and challenges, and can help save you time and reduce risk with support at implementation and beyond.

Dedicated project manager

As a HD™ 2.0 | RCM® customer, you’ll have a CSS consultant as your single point of contact – committed to helping your organization get the most out of your healthcare management system.

Automatic system upgrades and maintenance

Our engineers and analysts continually build and improve on an already superior product – with upgrades and maintenance automatically applied for hassle-free operation.

Experienced, knowledgeable support staff

Our experienced customer support team understands the complexities of healthcare operations. So they make sure everything – from implementation to training – goes smoothly with minimal disruption.

Accelerate your healthcare processes

Benefits of a Modern Revenue Cycle Management System

Reduce time & implement customized actions simply without the need of complicated workflow software. Perform vital tasks instantly and improve your healthcare management experience. Significantly reduce IT infrastructure costs.

What is a Financial Ecosystem?

Billions of dollars are lost annually due to the inadequate adoption of fintech technology for financial transactions management whereby mismanaged, aging receivables quickly turn revenues into bad debt and ultimately into losses. The primary reason for this outcome is the lack of a single enterprise solution that can manage every aspect of the revenue management life cycle process across all business units in unison.

Traditional platforms are stand-alone, independent systems that don't share common technology & can’t communicate dynamically with one another, leaving business units separated. This leaves entities with old, stale financial data, making it impossible to both manage aging receivables & avoid uncollectable debt. A Financial Ecosystem resolves this problem. A Financial Ecosystem is a battery of highly sophisticated proprietary fintech systems & solutions that consolidate into one single Financial Platform across your enterprise. HD™ 2.0 | Enterprise Financial Ecosystem® is that end-to-end financial platform that manages your revenues and receivables, while safeguarding bad debt exposure.

Parts of a Financial Ecosystem

HD™ 2.0 | LMS® Loan Management System (LMS) enables credit grantors & servicers to create business rules for underwriting decisioning workflows simply & visually without the need of complicated coding. LMS can systematically control financial screen navigation, input/output, verbose messaging and database interactions from any internal or external system or framework.

Now, when new applications for underwriting are introduced, they are first “interrogated” by the LMS business rules engine, which then gives a “thumbs up, thumbs down” decision.

This approach enables organizations to evaluate the application against multiple internal or external data sources and predict which applications should be manually reviewed, versus those that are most expected to contain appropriate information for automatic underwriting.

HD™ 2.0 | LMS® offers:

- Automation of manual procedures and calculations: By utilizing an automated analytic-based underwriting system, the consistency, quality and capacity of underwriting could be dramatically improved, allowing underwriters to focus on the exceptions.

- Control by business users: Rules are designed in an easy-to-understand visual Visio-like workflow designer, enabling the business experts— rather than technical staff—to control and automate procedures and policies.

- Faster response to change: Time-to-market for business logic changes are reduced from weeks and months to days or hours. Systems can be updated while in production with no down time and no need for IT resources.

- Increased reliability and auditability: A centralized workflow decisioning rules repository provides consistent execution of business policies that are easy to manage and visually easy to audit.

HD™ 2.0 | LMS® business rules engine allows for the development and rapid deployment of complex credit granting business rules, so your organization can make better decisions across the Revenue Life Cycle. Automate and optimize numerous types of business decisions, including credit approve/decline, instant prescreen offers, and collection decisions.

With HD™ 2.0 | LMS® you can also systematically analyze scoring, business rules and decision strategies from external data systems. This enables continuous testing and fine tuning of your business rules, so you can optimize decision strategies to drive higher profits.

- Pull data from multiple sources — both internal and external — into your decisioning engine dynamically.

- Process a high volume of transactions, with support and availability 24 hours a day

- Gain the ability to calculate numerous predictive attributes with self-designed scoring models

- Test new strategies against your current decision models and perform what-if simulations on historical data

- Improve business process efficiencies with continuous-loop deployment of enhanced and optimized decision strategies

- Deploy new decisioning strategies dynamically, to respond to market changes rapidly

- Deliver dynamic real-time, instant decisions while customers are at the point of sale

- Seamlessly integrate LMS's workflow decisioning engine into your existing systems with minimal IT costs

HD™ 2.0 | LMS® is specially designed to simplify and automate all loan processes from start to finish. This intelligent solution shepherds the user through each phase of the loan servicing process, presents the freshest data in real-time, and intuitively computes all calculations providing the easiest user-experience available anywhere.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver a salient automated enterprise invoicing solution. Generate business rules-driven invoicing with a built-in document management system. Offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

Give your customers what they want with customer-centric invoicing and payment options. Shorten your revenue cycle with a multitude of automated payment and invoicing technology solutions and easily track partial payments and past due invoices.

HD™ 2.0 | RMS® Receivables Management System (RMS) enables first and third-party administrators to deliver an automated rules-driven billing solution across the enterprise. Seamlessly retrieve documents, contracts, and offer online access for consumers and third-party administrators to reduce dependence on in-house customer service personnel while improving customer satisfaction.

With over 300+ modules dedicated to billing in real-time, HD™ 2.0 | RMS® provides the most comprehensive, state of the art tools to meet all your billing needs. With unparalleled automation, RMS minimizes training while maximizing production.

HD™ 2.0 | RMS® Receivables Management System (RMS) presents the most sophisticated tool set available for account receivables management, adaptable for any business or organization type. With capabilities to tie into the HD™ 2.0 Enterprise Financial Ecosystem, you can confidently expand your offerings across multiple industries and verticals for geometric growth.

HD™ 2.0 | RCM® is a healthcare Revenue Cycle Management (RCM) system designed to manage claim submissions, self-pay & insurer billing & recoveries.

HD™ 2.0 | TAX® is a tax billing, collections and legal case management system designed to generate & process tax bills, track collections, bankruptcies, skips, and legal cases on taxpayer liabilities of all debt types.

HD™ 2.0 | Collections® combines an easy-to-use collector interface with sophisticated management tools and blends them into a seamless environment. With the flexibility to manage billions of debtor accounts, handle thousands of users, and process accounts faster than any other platform available, it’s easy to see why HD™ 2.0 | Collections® is the most sought after collections system on the market.

HD™ 2.0 | Legal® delivers a complete legal case management & collections solution, which tracks legal cases, case parties, bankruptcies, linked cases, services, events, compliance & consent of judgment financial buckets. HD™ 2.0 | Legal® is the most powerful and widely used system for legal case management.

Growing portfolio size is what HD™ 2.0 | PM® (Portfolio Manager) was designed for. With unlimited scalability, PM consolidates your entire portfolio into a simple, easy to manage, user-friendly platform providing your organization with unified servicing practices, transparency, and increased borrower satisfaction.

HD™ 2.0 | CMS® consumer financial "Compliance Management System" (CMS) is designed to mirror CFPB, FDCPA & TCPA guidelines for state & federal compliance regulations.

HD™ 2.0 | CUBE® generates business rules sourced data sets for analytical reporting & business rules workflow processing.

HD™ 2.0 | Fusion® is a data interface communications bridge platform designed to link systems into the CSS IMPACT HD™ 2.0 ecosystem for dynamic access to external data. These external data sets are then exposed to HD™ 2.0's business rules workflow engine, data warehouse (CUBE) , & Ad hoc Report writer for data processing consumption.

HD™ 2.0 | Data Annex® is an online account annex portal designed for inter-departmental staff, field agents, or clients to manage and review accounts. HD™ 2.0 | Data Annex® is fully customizable to your organization's online branding presence.

HD™ 2.0 | Payment Portal® is an online consumer portal designed for self-serve account management, payments, negotiations & arrangements. HD™ 2.0 | Payment Portal® is fully customizable to your organization's online branding presence.

CSS's fintech consulting services cater to all financial technologies & solutions for every industry and vertical.

Get Started With CSS Impact

Sign-up and learn more about how our financial solutions can help make an impact on your bottom line.